Introduction

There has been a wall of worry for investors over the last year but as is often the case share markets climbed it. This resulted in another financial year of strong investment returns in 2023-24. But can it continue?

Key themes – lower inflation was the big one

Investment markets were hit hard in 2022 by surging inflation, interest rate hikes to combat it, fears that this would cause recession with various geopolitical threats (notably the war in Ukraine) not helping. This drove poor investment returns in 2021-22. However, inflation peaked in mid to late 2022 kicking off a new bull market in global shares from October 2022 which has been in place ever since. Against this backdrop, the key themes driving investment markets over the last 12 months have been:

-

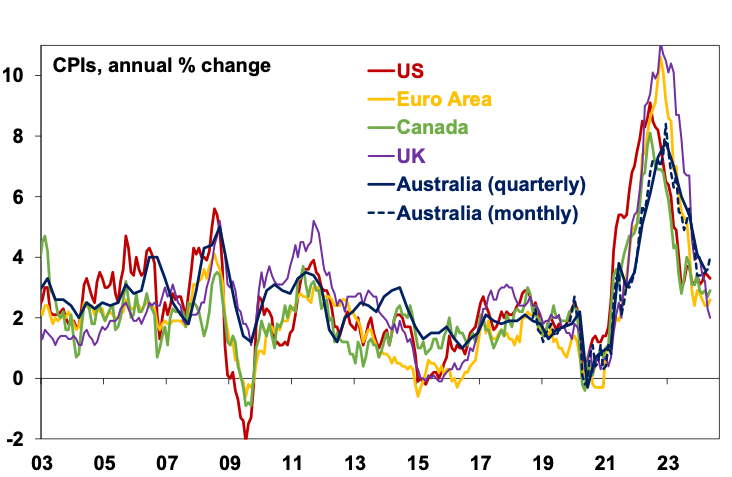

A further fall in inflation globally. While there have been a few scares along the way – notably into last October and earlier this year – the broad trend in inflation has remained down. This reflects improved goods supply, some lower commodity prices, lower transport costs, easing demand and cooling jobs markets.

Global Inflation

Source: Bloomberg, AMP

-

Australian inflation has also fallen but it’s lagging. This is not necessarily a concern as it lagged global inflation on the way up, peaked later and is lagging on the way down and the situation may be a bit confused by the new and incomplete monthly inflation indicator.

-

Central banks pivoting towards rate cuts. After slowing the pace of rate hikes, central banks have pivoted towards rate cuts albeit with expectations over the timing and extent of cuts waxing and waning and driving bouts of volatility along the way. Central banks in Switzerland, Sweden, Canada and the Eurozone have now started to cut with the US and UK expected to start around September.

-

The RBA is a laggard due to lagging disinflation. RBA rate cut expectations have been pushed to 2025 with a risk of another hike.

-

Better than feared global growth. While Europe & Japan have flirted with mild recession global growth generally has held up better than feared around 3%, led by the US. This in turn has supported profits.

-

China worries. Growth in China has been faltering with the property slump weighing but it’s remained around 4.5-5%. What’s more, the copper price reached a record high & iron ore prices remained strong.

-

Geopolitical threats remained high. The war in Ukraine continued to rage, Hamas attacked Israel with the aim of starting a war in Gaza, Iran and Israel traded missiles, Houthis have attacked shipping in the Red Sea, China/West tensions have continued to fester and the election in France threatens another Eurozone crisis. But so far, worst case scenarios have been averted with limited market impact.

-

AI enthusiasm. AI has continued to boost key, mainly US, tech stocks with optimism about its productivity enhancing benefits.

Another financial year of strong returns

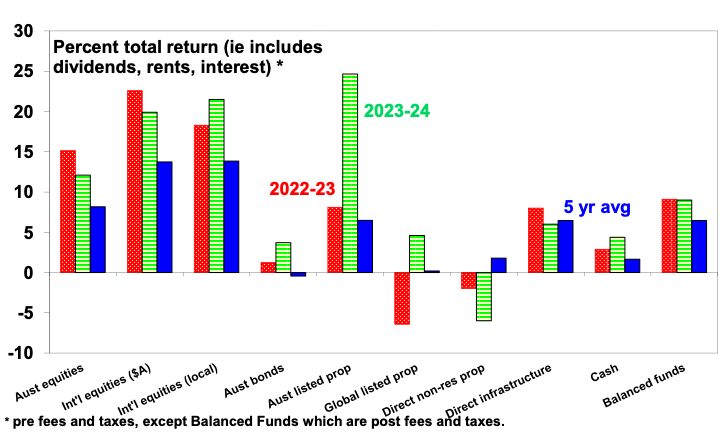

The net result has been another financial year of strong return for most assets as can be seen in the next chart.

2023-24 – major asset class returns

Source: Bloomberg, AMP

-

Global shares returned 21% in local currency terms over 2023-24, with a slight rise in the $A cutting this to a still strong 20% in $A terms. Japanese and US shares outperformed with the US continuing to benefit from the AI boost. Chinese shares fell again.

-

Australian shares returned 12%, benefitting from the positive global lead but were relative underperformers again on the back of China worries, the RBA lagging in moving to cut rates and the greater sensitivity of Australian households to higher rates.

-

Australian real estate investment trusts surged but global REITs only returned 4.6%.

-

Unlisted commercial property returns look to have been negative again as the lagged negative impact of higher bond yields and reduced space demand for office and retail weighed on capital values.

-

After seeing their worst loss in decades in 2022 as bond yields surged with inflation, bond returns have since stabilised with modest returns.

-

Cash returned 4.4% helped by two years of rate hikes.

-

Australian home prices rose 8% as a supply shortfall on the back of a surging population offset the drag from higher mortgage rates. Gains were concentrated in Perth, Brisbane and Adelaide though.

-

Combined, this drove an estimated 9% return in balanced growth superannuation funds for the second year in a row.

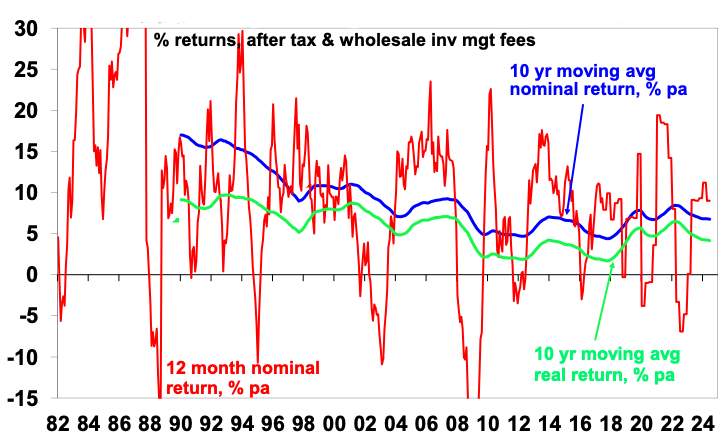

Balanced/growth superannuation fund returns

Source: AMP

The last few years has seen a zig-zag pattern in returns with average super funds seeing losses in 2019-20, very strong returns in 2020-21, a loss in 2021-22 (as inflation and bond yields surged) and have now had two years of strong returns. Given the volatility it’s best to focus on their longer-term average returns which has been 6.8% pa over the last decade or 4.2% pa after inflation. Which is pretty good as it’s after fees and taxes.

Some lessons from 2022-23

A big lesson of the last year is that monetary policy still works in slowing inflation (just as it was a key driver of its rise in 2021-22). Second, lower inflation is good for shares (assuming economic activity holds up). And finally, the last year was yet another reminder of just how hard it is to time markets. Numerous scares – inflation fears into October last year and more recently, Hamas’ attack on Israel, worries about the US election, worries about China – have threatened markets but they just kept going.

Expect a more constrained and volatile ride

Our base case is that share markets can continue to rally as more central banks join in cutting rates as inflation continues to fall towards central bank targets, including the Fed from around September and the RBA from around February enabling bond yields to fall and investors to focus on stronger growth in 2025. Our Inflation Indicator continues to point down for Australian inflation, despite recent setbacks.

However, the risks regarding equity markets are higher than a year ago:

-

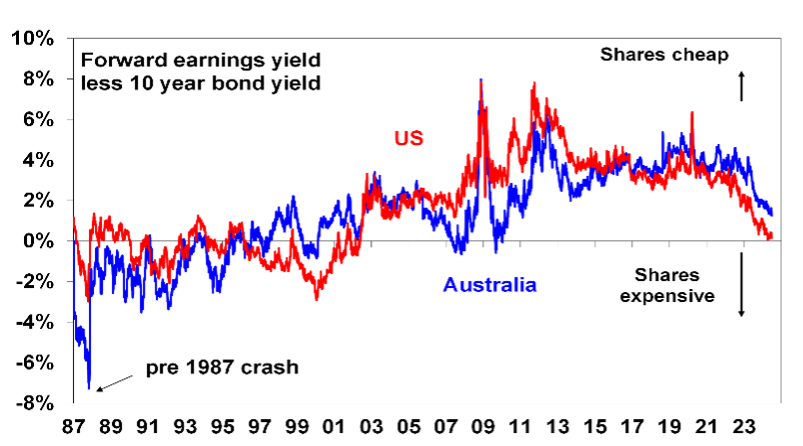

Shares are offering a low-risk premium over bonds compared to the experience of much of the last two decades, particularly US shares.

-

Investor sentiment levels are not at euphoric levels but are still elevated suggesting less tolerance for bad news.

-

Shares are technically overbought with narrow breadth in the critical US market with high reliance on Nvidia and tech to push it higher.

Equity risk premium over bonds

Source: Bloomberg, AMP

-

The risk of recession in the US and Australia remains high, with increasing signs that the US economy is now slowing (particularly evident in labour market and consumer indicators) and the Australian economy close to stalling in the March quarter and set to lose support from surging population growth. This would threaten earnings growth expectations for 2024-25.

-

Geopolitical risk is high. In particular:

-

With Trump ahead in the polls and betting markets (PredictIt has Trump at 58% probability of winning versus Biden at 33%) the focus will increasingly turn to his policies which – with higher tariffs, lower taxes, lower immigration and a less independent Fed – suggests bigger budget deficits (bad for bonds) and higher inflation;

-

The far-right National Rally’s “win” in the first round French elections runs the risk of another Eurozone crisis. It may not get enough seats to form Government though, which could result in a hung parliament – the least bad option, but if it does it could lead to conflict with the European Commission over fiscal policy. That said it’s worth bearing in mind that market riots with surging bond yields headed off economically irresponsible policies in Greece (under Syriza), the UK (under PM Truss) and Italy (under the far-right Brothers of Italy) & the same would likely happen in France but the market riot would still mean a period of market volatility;

-

And risks remain around Israel and Iran and Ukraine.

-

Our base case is for more constrained returns in the current financial year of 6-7% down from the 9% or so seen over the last year. However, the risk of another correction in shares is high and investors should allow for a more volatile ride than seen over the last year.

It’s also worth noting that unlisted property returns are also likely to be negative over the year ahead as weak economic activity and the adjustment to working from home result in rising office property vacancy rates (as leases expire) & more downwards pressure on property values.

Things for investors to keep in mind

Of course, short term forecasting and market timing is fraught with difficulty and it’s best to stick to sound long term investment principles. Several things are always worth keeping in mind: periodic and often sharp setbacks in shares are normal; selling shares or switching to a more conservative superannuation strategy after falls just turns a paper loss into a real loss; when shares and other investments fall in value they are cheaper and offer higher long term return prospects; Australian shares still offer an attractive dividend yield; shares and other assets invariably bottom when most investors are bearish; and during periods of uncertainty, when negative news reaches fever pitch, it makes sense to turn down the noise around investment markets in order to stick to an appropriate long term investment strategy.

Dr Shane Oliver – Head of Investment Strategy and Chief Economist, AMP

Source: AMP Capital July 2024

Important note: While every care has been taken in the preparation of this document, AMP Capital Investors Limited (ABN 59 001 777 591, AFSL 232497) and AMP Capital Funds Management Limited (ABN 15 159 557 721, AFSL 426455) make no representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This document is solely for the use of the party to whom it is provided.