Commercial real estate is a popular choice among Australian and foreign investors given the current low interest rate environment. At a time when the value of global bond yields is low, defensive investors are searching elsewhere for yield and property is an attractive option; particularly those assets that have provided an income guarantee.

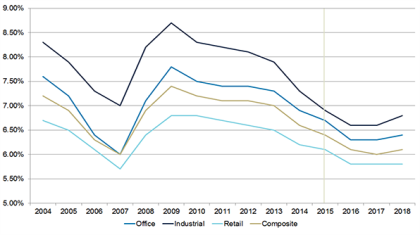

Due to the high value of sales that have transacted over the past 12 months, property yields – i.e. the rate of return based on the expected income of the property – are compressing and some sub-markets have matched or exceeded their 2007 peaks, as shown in the below graph.

Yield compression over the past decade

Source: JLL Research/AMP Capital (forecasts)

Past performance is not a reliable indicator of future performance

The resulting high property prices indicates that investors view commercial real estate as a low-risk, high-return investment, for which they are willing to purchase without the promise of immediate return, given the longer term income potential.

How much further will yields fall?

Yields are expected to fall further in 2016, with overall sector averages matching the 2007 peak. Popular assets/markets such as trophy assets, assets in markets with improving rental growth prospects and those with secure high yield are likely to see rates fall even below their 2007 peaks, as we have seen happen in many overseas markets.

In our view, the chase for yield will continue until interest rates start rising, global economic growth starts gaining steady momentum and the volatility in share markets subsides. At this stage, this proposition is looking likely to occur onwards of 2017.

We also expect approximately another 12-18 months of yield chase for the following reasons:

-

Australia’s short-term economic growth outlook is tepid– the growth environment will remain sluggish, with AMP Capital and the Reserve Bank of Australia (RBA) forecasting Gross Domestic Product (GDP) growth of only 2-2.5% p.a. in the short-term.

-

Real estate prices are attractive compared to alternative asset classes– the spread in yields to bonds is close to a historically wide range. Real estate income yields and prices are less volatile than some other asset classes, favoured by many investors in the current world of excessive volatility and low growth.

-

Interest rate falls– long and shorter-term interest rates could fall further in the next six months if Australian or Chinese economic growth deteriorates. Core inflation is running towards the bottom end of the RBA’s 2-3% target range giving it room to decrease interest rates further to protect the economy.

-

Australia’s higher running yields and falling dollar attracts foreign investors– this is despite concerns about the end of the mining boom and an overheated housing market in Sydney and Melbourne.

-

Real estate debt is highly accretive to property income yield– this means there is a chance the leveraged buyer will return, setting new price benchmarks.

What does the chase for yield and rising prices mean for property investment?

The movement in yields to date has propelled the total return for the Australian commercial real estate market upwards into double digits and we expect this to continue until yields bottom. Over the next three years, we expect prime returns to average 9.5-10% p.a. across the sectors, with greater prospects for yield compression and improving rental growth forecasts in sectors such as the non-resource state office markets and the high growth regional and sub-regional shopping centres.

While there is still some yield compression left in the market, property values are now sitting up around the 10-11 o’clock position on the cycle. This is a less attractive entry point for buying into real estate unless assets have strong rental growth prospects or some form of repositioning to alternative uses.

The dynamics of the global economic environment and consequent challenges mean uncertain times for commercial real estate and for all sectors. In the short term, the chase for yield is a positive trend but is pushing prices ahead of rental growth, which could cause a risk for low rental growth assets when interest rates rise. On balance, our quantitative models are confirming our observations that the market is well along in the cycle and now is the time to capitalise on the weight of money, and position funds and assets for the volatility and structural headwinds in the medium term.

About the Author

Michael Kingcott, Head of Property Investment Strategy and Research, AMP Capital

Michael is the Manager of the Property Investment Strategy and Research Team, responsible for leading a team of property investment analysts who monitor and forecast the domestic and international property markets.

Important note: While every care has been taken in the preparation of this article, AMP Capital Investors Limited (ABN 59 001 777 591, AFSL 232497) and AMP Capital Funds Management Limited (ABN 15 159 557 721, AFSL 426455) makes no representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This article has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this article, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This article is solely for the use of the party to whom it is provided.