Introduction

For much of this year the big debate (or obsession) for investors has been about when the Fed would start to raise interest rates after nearly seven years of being near zero. After delays in June and September attention is now focussed on the December 15-16 Fed meeting following the Fed’s indication at its October meeting that it will consider a hike then and much stronger than expected jobs data for October. US money markets are pricing in a 66% chance of a move in December.

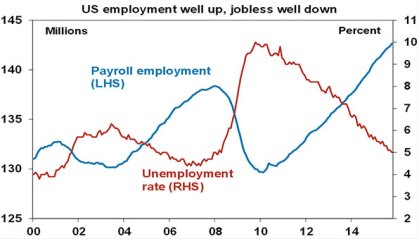

The Fed’s inclination to start hiking is understandable. The extraordinary monetary easing since the GFC (zero interest rates and three rounds of quantitative easing) have done their job in restoring US growth. Jobs are well up on 2008 levels, unemployment is down to 5%, confidence is up, the housing sector has recovered and business is investing again. And since inflation normally only turns up with a lag the Fed feels there is an argument to get going.

Source: Bloomberg, AMP Capital

However, heightened expectations of a hike in December have seen a return to the sort of worries that drove share markets lower into August/September with investors fearful a Fed hike will put upwards pressure on the $US which in turn will drive commodity prices lower, accentuate the risk of problems in the emerging world and adversely affect US economic growth. As a result shares, commodity prices and emerging market currencies have seen some renewed volatility or outright falls so far this month. More broadly it’s understandable for investors to be wary as they have become used to zero interest rates and the fragile state of US and global growth along with deflationary risks suggest that there is a risk that the Fed may make a mistake in hiking. There is long list of countries that have raised interest rates since the GFC only to cut them again. This includes Australia, Canada, Norway, New Zealand, Sweden and the Eurozone. Japan had a similar experience in the 2000s. So there is a risk that the Fed could make a similar mistake.

Given all this, Fed related uncertainty/nervousness could continue at least until the Fed’s December decision is out of the way. However, there are several reasons not to be too concerned about the Fed.

Reason #1- Fed hikes conditional on a stronger US

The Fed has clearly made its first interest rate hike conditional on the economy moving in line with its relatively upbeat expectations, specifically “that unanticipated shocks do not adversely affect the economic outlook and that incoming data support the expectation that labor market conditions will continue to improve and that inflation will return to the [Fed’s] 2% objective over the medium term.” By delaying in September the Fed clearly indicated that its conditionality was serious and that the conditions had not yet been met. This all means that if the Fed does hike in December or whenever, it will only be because the economy is stronger and the Fed is confident that this will continue – in other words it will be a “good hike”. And subsequent moves will also be conditional on further improvement in the US economy. Given ongoing constraints on growth and inflation I expect that rate hikes will be very gradual, ie below Fed members’ expectations for the Fed Funds rate (commonly called the “dot plot”) to reach 1.5% by end 2016 and 2.6% by end 2017. In fact the Fed’s December meeting is likely to see these expectations revised down again. Periodic growth scares – like bad weather, China worries and terrorist attacks only add to this.

Reason #2 – history

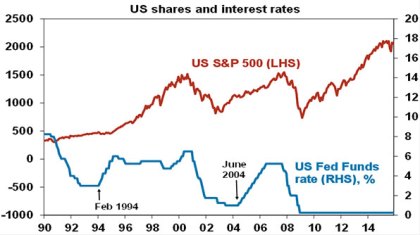

US economic downturns/recessions have historically only come three years after the first Fed rate hike in a cycle. In fact, recession did not come until seven years after the February 1994 first hike and for three and a half years after the June 2004 first hike. This is because the first rate hike only takes monetary policy from very easy to a bit less easy and it’s only when monetary policy becomes tight after several rate hikes that the economy gets hit. This is often signalled by long term bond yields falling below short term interest rates (ie an inverted yield curve). And we are a long way from that.

Flowing from this, while there can be share market wobbles around the first Fed rate hike after major easing cycles, sustained problems usually only set in when interest rates/monetary policy has become tight. This can be seen in the next chart. Shares had wobbles when interest rates first started to move up in February 1994 (US shares had a 9% correction at the time) and in June 2004 (US shares had a 8% correction at the time) but bear markets did not set in till 2000 and 2007 after multiple hikes and with recessions around the corner.

Source: Bloomberg, AMP Capital

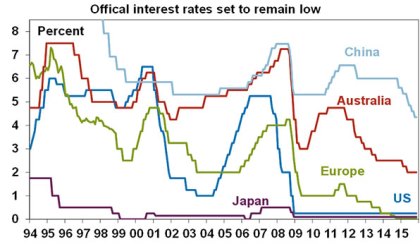

Reason #3 – Other major countries are still easing

Although the US may start raising interest rates, other major central banks are still moving in the direction of monetary easing or at least are a long way from hiking. This includes the People’s Bank of China (which is expected to cut interest rates further), the ECB and Bank of Japan (which are biased to expanding their quantitative easing programs) and the Reserve Bank of Australia (which still has a bias to cutting interest rates further). In other words, even when the Fed moves global monetary policy will remain easy. This divergence is very different to the period prior to the GFC.

Source: Bloomberg, AMP Capital

Reason #4 – the $US will constrain the Fed

Since the start of last year the $US has risen by just over 20% against a trade weighted basket of currencies. This has largely reflected expectations that the US is moving towards monetary tightening at a time when other key central banks are still easing, which in turn has made the $US relatively more attractive. A rising currency is a form of monetary tightening because it bears down on economic growth (by making the US less competitive) and inflation (by reducing import prices). According to a Fed model of the US economy the 20% rise in the value of the $US since the start of last year is equivalent to around 150 basis points of rate hikes. In other word, the rise in the US dollar has done much of the Fed’s job for it.

A rising $US also puts downwards pressure on commodity prices because most commodities are priced in US dollars, which in turn weighs on US inflation.

So with US growth still being relatively fragile (it has averaged just 2% since the GFC ended whereas a period of much stronger growth would normally have been seen after such a severe recession) and its preferred measure of inflation still running well below target (the private final consumption deflator is running at 1.3% year on year versus a target of 2%) the Fed is unlikely to want to see a further sharp increase in the $US.

As a result with other major central banks still easing, upwards pressure on the value of the $US will act as a brake on how much the Fed can raise interest rates. And in order to stop the $US rising too much the Fed is likely to talk dovish in stressing a gradual tightening cycle. This has indeed been seen in recent Fed comments and is likely to remain the case.

Reason #5 – non-US shares are cheap

While US shares are expensive on some measures – particularly if low bond yields are not allowed for – this is not the case for non-US share markets which are cheap whether low bond yields are allowed for or not. For example, while the so-called Shiller price to earnings multiple or cyclically adjusted PE – which compares share prices to a rolling ten year moving average of earnings to smooth out the earnings cycle – puts US shares at 26 times, global shares excluding the US are only trading on 15 times. See the next chart.

Source: Global Financial Data, AMP Capital

In fact, global shares excluding the US are about as cheap as they ever get on this measure. This includes Australian shares. This is very different to 2000 or 2007 when most share markets were expensive on this measure. This tells us that there are still plenty of opportunities in global shares for investors (even if Fed hikes continue to put a brake on US shares).

Concluding comments

The anticipation of and worries about the Fed’s first interest rate hike in seven years have been a major driver of investment markets for at least the last year. These worries could have further to go. However, it may be overkill to take this took far. First, when it does hike (with December now looking likely) it will be the most anticipated Fed rate hike in history. When it comes it will hardly be a shock to anyone. Second, there are several fundamental reasons not to be too concerned about the Fed: the first and subsequent rate hikes will be conditional on the US economy continuing to improve and given constrained growth and deflationary pressures the process is likely to be very gradual; history tells us that its only when monetary policy becomes tight that it becomes a real problem and that is a long way off; global monetary conditions will remain easy as other major countries are still easing; the strength of the $US will constrain how much US rates will go up; and, while US shares are expensive on some measures, shares outside the US are cheap indicating that there are still plenty of opportunities for investors.

AMP Capital Markets 19 November 2015

About the Author

Dr Shane Oliver, Head of Investment Strategy and Economics and Chief Economist at AMP Capital is responsible for AMP Capital’s diversified investment funds. He also provides economic forecasts and analysis of key variables and issues affecting, or likely to affect, all asset markets.

Important note: While every care has been taken in the preparation of this article, AMP Capital Investors Limited (ABN 59 001 777 591, AFSL 232497) and AMP Capital Funds Management Limited (ABN 15 159 557 721, AFSL 426455) makes no representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This article has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this article, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This article is solely for the use of the party to whom it is provided.