Retirees now face a bold truth: investing in traditional safe haven assets do not provide the returns they once did. So, where to from here?

The first thing is to accept that today’s returns are lower on retiree favourites, like cash and bonds.

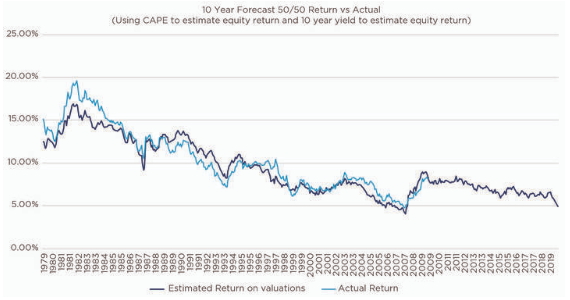

Second, there are tools available to provide forecasts for what the market will return over a 10-year period. These forecasts have been relatively reliable through history and are useful for investors who, understandably, are looking at short-term volatility and thinking there is no hope in predicting long-term patterns.

What the future could look like

In our view, investors should expect lower returns on bonds over the next 10 years than the past 10 years, simply because the starting point of today’s yields is extremely low.

Low bond yields have the potential to cause other riskier assets such as equities to trade at higher valuations and therefore also offer lower expected returns. Because of market conditions, annuities may also pay less.

The combined effect in our view is that the expected return on a simple 50/50 stocks and bonds portfolio is likely to be less than 5% p.a. over the next 10 years1. The only compensation accompanying these lower returns is that this environment is likely to produce lower levels of inflation.

Source: Bloomberg, 30 August 2019

This is the lowest forecast return for this type of portfolio in history, matched only by those made in the run-up to the global financial crisis. In that instance, high equity valuations were driving down expected returns. This time, it’s low bond yields.

This is a very importance difference; if you were aware in 2007 that equities were the source of deterioration in your expected return, you could de-risk your portfolio into cash and bonds and still expect a reasonable result. However, in 2019, there is nowhere to hide.

To avoid the risk of holding a poorly performing asset, like cash and bonds, one option is to look beyond these conservative asset classes and take on higher levels of risk with more volatile assets. At a time when investors can least afford shocks to the downside, this is a conundrum with no simple answer.

Retirement savings, then and now

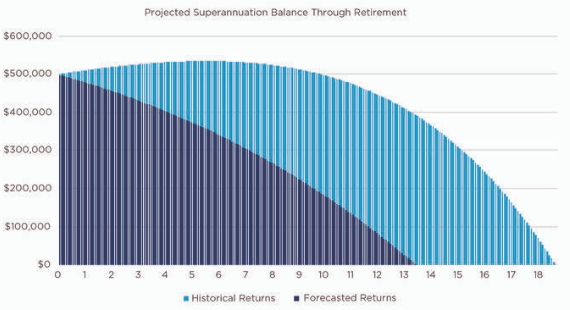

For retirees whose focus is to preserve and prolong their stockpile, all this begs the question: how large a reduction in retirement income should one expect?

To illustrate how much lower today’s average retirement income is expected to be, we can simulate a $500,000 investment in a simple portfolio of 50% Australian government bonds and 50% Australian shares with our current expected return of 4.9% and 2.5% inflation. Before looking at the chart, consider how far this is from the 11.9% historical return and 5.3% inflation rates of the halcyon days. This is where it hits home.

Source: AMP Capital

The bottom line is: retirement savings won’t last nearly as long as they have in the past. Based on the average market return from 1969 to today, a retiree could have expected to receive a comfortable retirement income2 for 18.5 years. For retirees in 2019, that drops down to just 13.5 years.

There is no doubt that the investment environment moving forward is going to be significantly more challenging than it has in the recent past, with today’s retiree facing the prospect of some of the lowest returns in living memory.

What retirees can do?

Still, far from waving the white flag, in our view there are some things investors can do to improve their prospects.

With traditional strategies returning less in today’s environment, retirees will now more than ever reap the benefit of a good adviser. Three investment strategies which could help manage the situation are:

-

Retirees can seek higher returns from active management. By finding managers who can outperform the market, retirees can give their returns a boost that may go some way to offsetting the impact of lower market returns.

-

Retirees can also employ a dynamic asset allocation approach in their diversified portfolio. Dynamic asset allocation seeks to navigate the market cycle and gain exposure to asset classes that are delivering the most attractive returns. By dynamically managing their exposure to different asset classes through the cycle, retirees may be able to secure more attractive returns and better manage risk compared to a traditional ‘buy and hold’ strategy.

-

Retirees could consider increasing their exposure to alternative sources of return that aren’t linked to bond and equity markets and aren’t likely to suffer as badly from the low-return environment.

Additionally, retirees will benefit from an effectively constructed portfolio that minimises waste, such as transaction costs, and maximises structural advantages, such as access to franking credits.

Unfortunately, there is no magic tonic for the situation and retirees should be wary of anyone claiming to have one. However, by partnering with a good adviser, managing their expectations and positioning their portfolio for a lower return future, they will be in the best possible position to thrive.

Author: Darren Beesley, BCom FIAA, Head of Retirement and Senior Portfolio Manager, Sydney, Australia

Source: AMP Capital 9 Oct 2019

1 Based on an expected 10 year return on Australian government bonds equal to current 10-year bond yield of 0.9% and expected return on equities of 8.9% based on a historical regression of 10 year returns against starting Cyclically Adjusted Price/Earnings Ratio of 20.3

2 As defined by ASFA’s retirement income standards

Important notes: While every care has been taken in the preparation of this article, AMP Capital Investors Limited (ABN 59 001 777 591, AFSL 232497) and AMP Capital Funds Management Limited (ABN 15 159 557 721, AFSL 426455) (AMP Capital) makes no representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This article has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this article, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This article is solely for the use of the party to whom it is provided and must not be provided to any other person or entity without the express written consent of AMP Capital.