As far as real estate sectors go, retail has been the most challenged globally over the past 24 months. With a valuation correction occurring through the pandemic, retail is now starting to garner stronger investor interest given its attractive yield relative to other asset classes. There is clearly a greater understanding of the role quality retail centres can play in an institutional portfolio and while diligent asset selection and risk underwriting are still essential, a look at the drivers of retail real estate performance can help explain why transaction markets are starting to thaw.

Cashed up consumers ready to spend in 2022

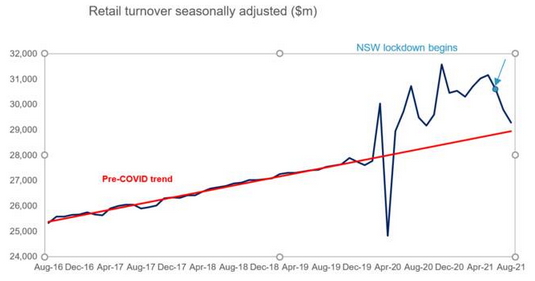

Retail consumption soared through the pandemic as spend rotated out of service-based industries (particularly tourism) to goods such as apparel, electronics and furniture. At its peak (Nov-2020), retail trade reached levels around 11% higher than what we would have expected without COVID-191. Unfortunately, things took a turn for the worse in the new financial year, with the New South Wales and Victorian lockdowns preventing nearly 60% of the Australian population from engaging with any non-essential physical retail (see below).

Surging vaccination rates have resulted in New South Wales and Victoria beginning to exit their lockdowns during Q4, giving frustrated consumers an opportunity to release pent-up demand. While official ABS data lags and thus is yet to show the rebound, the experience across AMP Capital shopping centres, and feedback from our retail tenants, indicate spending in the weeks post re-opening has been robust.

The good news is this spending momentum is set to continue into 2022. Consumers have saved ~$90b more in bank deposits than would be expected in a typical year, giving the economy plenty of firepower heading into the new year2. With confidence remaining higher than pre-COVID levels and the outlook for the jobs market relatively strong, consumers are more likely to feel comfortable parting with some of their savings over the next 12 months3.

Potential upside in foundations of retail growth

Looking beyond the 2022 ‘bump’ expected in retail trade, we are focused on the fundamental drivers of retail sales which underpin the medium-term outlook for the sector. These are population growth, real growth per capita (people buying more things) and retail price inflation.

Population growth has been the dominant driver of Australian retail sales in recent history, averaging 1.6% p.a. (five years pre-COVID) which exceeds the growth rates seen in most emerging economies4. Around 60% of that growth has been from overseas migrants, who are typically younger and in the ‘household formation’ stage of their lives – good news for retail5.

While this tailwind has largely disappeared throughout the pandemic as population growth plunged to record lows, once international borders are open it will continue to be an important driver of growth with significant upside potential. Public discourse has once again begun around the merits of a strong immigration program, with some commentators suggesting a doubling of pre-COVID levels would be appropriate. The level of inbound migration which would result under that plan is at the high-end and unlikely to be viable politically, however a tighter-than-expected labour market should encourage a robust migration boost.

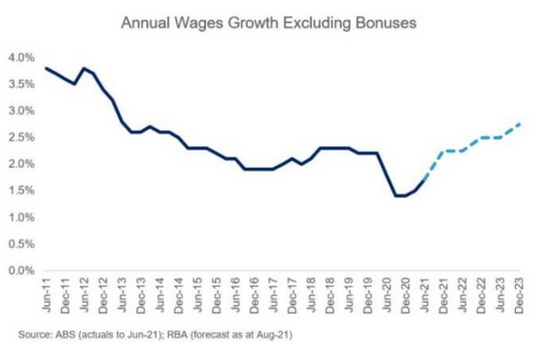

The main driver of real retail growth per capita is rising wages. Uninspiring for several years, the medium-term outlook for wages growth (excluding bonuses) has improved with the RBA forecasting 2.5% by the end of 2022, a level not seen since 2014. Further improvement should be gradual, but monetary policy settings are expected to remain very supportive of economic growth until annual wages growth sustainably exceeds 3%6.

In our opinion, inflation, which was soft prior to the pandemic, will increase due to a tighter labour market. In the near-term though, inflation readings are likely to be volatile as global supply chain bottlenecks are worked through. Once we’re through these pandemic-related distortions, we expect the inflation trajectory to align to the steady improvement in wages growth and continue to rise in the medium-term.

In aggregate, inflation is not as relevant to the outlook for retail compared to population and wages growth – rent escalations are often CPI-linked and therefore provide inflation protection. However, the experience can be different at a category level (e.g. apparel versus electronics), where competitive dynamics may assist or inhibit a retailer’s ability to pass on cost increases.

Not a rising tide, but attractive returns are available

Gone are the days of ‘set and forget’ allocations to retail real estate – it requires quality active and innovative management to ensure ongoing relevance in a world where change is the only constant. While the outlook for demand drivers has improved, there are several challenges facing the retail sector which need to be navigated to deliver attractive risk-adjusted investment returns.

The rise of e-commerce remains the most obvious and significant trend. According to ABS Retail Trade figures, Australian online retail trade has increased in market share from 6.4% pre-COVID to 10.4% today7. Positively for shopping centres, such growth wouldn’t be possible without physical store networks. The right store in the right location provides a rich experience and quality customer service, as well as cost-effective brand awareness and customer acquisition. This “halo effect” means multichannel retailers – those which utilise both physical and digital channels – continue to outperform online-only brands (in terms of growth and market share) by serving customers wherever, whenever and however it suits them. As a result, space remains in demand at shopping centres that offer prime locations and quality catchment areas. We are seeing more retailers taking an omni-channel approach across our portfolio which will serve them well in the long-term.

The ongoing closure of department store space is arguably the other major important consideration. Myer and David Jones have both shrunk their physical footprint in recent years with the clear implication for shopping centres being temporary loss of direct income, potentially reduced foot traffic draw for other retailers and the need for capital expenditure to repurpose space. However, it is important to place the downsizing in context. Using Myer as an example, a further 70,000 square metres of space is earmarked for closure beyond FY21. Myer’s total footprint is around one million square metres, meaning most department stores will remain unchanged. For those that do shrink or close entirely the net outcome for shopping centre owners may still be neutral, or even positive, if the space can be backfilled on attractive terms or the closure enables an accretive development in line with contemporary trends (including mixed use).

Opportunity beckons

The above aren’t the only important shifts occurring in retail real estate, but they both highlight that opportunity beckons for managers and owners that take an active, innovative and adaptive approach to leveraging the opportunities that technology and demographic drivers present.

While challenged assets in less desirable locations will likely continue to struggle, we expect to see outperformance increasingly accrue to assets which are well located and can successfully face into the ‘new economy’ via resilient tenant mixes and omnichannel relevance.

For investors who are ready to look beyond the challenges the sector has faced over the last couple of years, retail remains an exciting investment and development proposition, offering a multi-tenanted and increasingly diversified income stream at attractive yield spreads.

1. ABS Retail Trade, Australia

2. Estimate based on APRA data as at August 2021

3. Deloitte Access Economics

4. ABS Population

5. ABS Population

6. Reserve Bank of Australia, Statement on Monetary Policy, August 2021

7. ABS Retail Trade, Australia (Aug-21) 2021 Myer Annual Report, available from www.investor.myer.com.au

Author: Colin Mackay, Investment Research Analyst, Real Estate Research Sydney, Australia

Source: AMP Capital 9 December 2021

Reproduced with the permission of the AMP Capital. This article was originally published at AMP Capital

Important notes: While every care has been taken in the preparation of this article, AMP Capital Investors Limited (ABN 59 001 777 591, AFSL 232497) and AMP Capital Funds Management Limited (ABN 15 159 557 721, AFSL 426455) (AMP Capital) makes no representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This article has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this article, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This article is solely for the use of the party to whom it is provided and must not be provided to any other person or entity without the express written consent of AMP Capital.

This article is not intended for distribution or use in any jurisdiction where it would be contrary to applicable laws, regulations or directives and does not constitute a recommendation, offer, solicitation or invitation to invest.