Five key themes from 2023

Despite lots of angst at the start of the year, 2023 turned out far better than feared. Key big picture themes of relevance for investors were:

-

Stronger than feared growth. Despite fears that recession was inevitable, on the back of multiple rate hikes and a rough reopening in China, it’s been avoided so far, including in Australia, helped by saving buffers, reopening boosts particularly to eating out & travel and some labour hoarding. Economic growth in 2023 looks to have been around 3% globally and around 1.9% in Australia which was helped by a population surge partly offsetting severe mortgage pain for some.

-

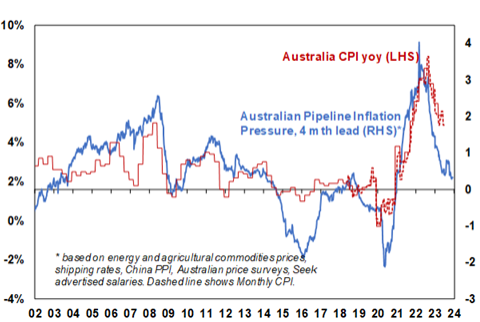

Disinflation. Inflation across major countries has fallen sharply from peaks of 8 to 11% last year to around 2 to 5%. Australia lagged on the way up and is doing the same on the way down, but it’s falling too.

Inflation – falling as fast as it went up

Source: Bloomberg, AMP

-

Peak interest rates. It took longer to get there and there was a “high for longer” scare on rates but most major central bank policy rates look to have peaked and this probably includes the RBA’s cash rate.

-

Geopolitical threats proved not to be as worrying as feared – the war in Ukraine remained contained, conflict in Israel flared again but so far has not spread to key oil producers (oil prices actually fell a bit) & the Cold War with China thawed a bit. A lack of major elections helped.

-

Artificial intelligence hit the big time after the launch of Chat GPT with hopes it will boost productivity. The immediate beneficiaries were key (mostly US) tech stocks – which helped them reverse the 2022 slump.

The return of Goldilocks

There were lots of bumps along the way – notably in the seasonally weak August to October period on the back of the sticky inflation/high for longer rates scare. But for diversified investors 2023 turned out okay with okay growth & falling inflation. The next table shows investment returns.

Investment returns for major asset classes

|

Total return %, pre fees and tax |

2022 actual |

2023 actual* |

2023 forecast |

|

Global shares (in Aust dollars) |

-12.5 |

21.0 |

5.0 |

|

Global shares (in local currency) |

-16.4 |

18.5 |

7.0 |

|

Asian shares (in local currency) |

-18.3 |

1.5 |

9.0 |

|

Emerging mkt shares (local currency) |

-15.5 |

6.5 |

9.0 |

|

Australian shares |

-1.1 |

5.1 |

9.0 |

|

Global bonds (hedged into $A) |

-12.3 |

2.2 |

4.5 |

|

Australian bonds |

-9.7 |

2.3 |

4.5 |

|

Global real estate investment trusts |

-25.9 |

-1.2 |

9.0 |

|

Aust real estate investment trusts |

-20.5 |

5.5 |

9.0 |

|

Unlisted non-res property, estimate |

9.5 |

-5.0 |

-5.0 |

|

Unlisted infrastructure, estimate |

4.0 |

5.0 |

7.0 |

|

Aust residential property, estimate |

-7.0 |

10.0 |

-1.0 |

|

Cash |

1.3 |

3.5 |

4.2 |

|

Avg balanced super fund, ex fees & tax |

-5.2 |

7.2 |

5.3 |

* Year to date to Nov. Source: Bloomberg, Morningstar, REIA, CoreLogic, AMP

-

Global shares had a strong year as investors looked through more rate hikes and focussed on still strong profits and prospects for rate cuts.

-

Chinese shares underperformed again on economic and property worries and this weighed on emerging market shares. Japanese shares outperformed followed by US shares with its high-tech weight.

-

After outperforming in 2022, Australian shares underperformed on the back of worries about China & interest rate sensitive consumers.

-

Government bonds slumped into October as yields rose to new highs but then rallied in anticipation of rate cuts giving modest returns.

-

Real estate investment trusts remained constrained by higher bond yields and worries about reduced space demand.

-

Unlisted assets were constrained by the valuation effect of high bond yields with property seeing losses from reduced space demand.

-

Australian home prices rebounded as a supply shortfall with booming immigration swamped the negative effect of higher mortgage rates.

-

Cash and bank term deposit returns improved substantially.

-

The $A fell with higher US interest rates versus Australian rates and China growth worries before a partial recovery from October.

-

Reflecting all this, balanced super funds had solid returns, continuing a zig zag pattern of strong, weak, strong, etc, years since 2017.

Four big worries for 2024

The worry list remains long:

-

Inflation is still too high in most major countries – so central banks could still have another hawkish turn if it proves sticky above targets.

-

The risk of recession is high reflecting the lagged impact of rate hikes. It’s hard to see how the biggest rate hiking cycle won’t have a major impact and the risks are already evident in tighter lending standards in the US, falling lending in Europe and stalling consumer spending in Australia. And unlike a year ago many are no longer worried about a recession which is negative from a contrarian perspective.

-

Risks around the Chinese economy and property sector remain high.

-

Geopolitical risk is high: with half the world’s population seeing 2024 elections including the US, the EU, India, Russia & South Africa; the US Government could have a shutdown starting 19 January & could have another divisive Biden v Trump presidential election with a Trump victory running the risk of weakening US democracy & US alliances & another trade war; the result of Taiwan’s 13 January election could see an easing or an escalation of tensions with China depending who wins; the war in Ukraine is continuing; and there is a high risk that the Israel/Hamas war could spread, eg to Iran, threatening oil supplies.

The recession risk suggests a high risk of a sharp pull back in shares.

Three reasons for optimism

However, there is reason for optimism. First, inflation has eased sharply to around 3% in major industrial countries and around 5% in Australia and is likely to continue to fall as: supply chain pressures have reversed; demand is cooling; and labour markets are easing with sharp falls in job vacancies. This includes in Australia which lagged US inflation on the way up and is just doing so again on the way down with our Inflation Indicator pointing to a further sharp fall.

Australia Pipeline Inflation Indicator

Source: Bloomberg, AMP

Second, we expect central banks in the US, Canada and Europe to start cutting rates in March or the June quarter. While there is still a high risk of one more hike in Australia in February, falling inflation should head this off so our base case is that the RBA has peaked ahead of rate cuts in the September quarter, taking the cash rate down to 3.6% by year end.

Third, while recession is a high risk and markets are no longer priced for it unlike at the start of 2023 if it does occur it should be mild:

-

Most countries have not seen a spending boom that needs to be unwound and traditionally makes recessions deep. For example, in the US there has been no overinvestment in housing and capex, leverage is low and inventory levels are low.

-

Similarly, in Australia consumer spending, housing investment and business investment are not running at excessive levels relative to GDP. And there is still a large pipeline of home building work yet to be done providing some offset to the slump in building approvals, and business investment plans still point to growth (albeit slower than it has been).

-

Chinese growth has well and truly lost its lustre and property sector risks are high, but it’s likely to target roughly 5% GDP growth again and back this up with more fiscal stimulus if need be.

Finally, while there are a lot of geopolitical risks to keep an eye on it may not turn out badly: the US has a strong incentive to avoid an escalation in the Israel/Hamas war; the stalemate in Ukraine could turn into a frozen conflict – not good for Ukraine but no problem for investment markets; and elections won’t necessarily go in an adverse direction for markets. In relation to the US, the presidential election year normally sees average share returns (it’s the next two years that are normally sub-par), and since 1927 US shares have only had negative returns in four election years and for those worried about Trump it could turn out to be Nikki Haley.

Overall, global growth in 2024 is likely to be around 2.5%, down from around 3% in 2023, but not disastrous – with weakness in the first half and stronger conditions in the second half going into 2025. In Australia, growth is expected to slow to 1.5% in the year ahead with very weak, possibly mild recession conditions in the first half but stronger conditions later. Inflation is expected to fall to 3% in Australia.

Implications for investors

Easing inflation pressures, central banks moving to cut rates and prospects for stronger growth in 2025 should make for okay returns in 2024. However, with growth still slowing, shares historically tending to fall during the initial phase of rate cuts, a very high risk of recession and investors and share market valuations no longer positioned for recession, it’s likely to be a rougher and more constrained ride than in 2023.

-

Global shares are expected to return a far more constrained 7%. The first half could be rough as growth weakens and possibly goes negative and valuations are less attractive than a year ago, but shares should ultimately benefit from rate cuts and lower bond yields and the anticipation of stronger growth later in the year and in 2025. Expect a slight outperformance by Asian and emerging market shares.

-

Australian shares are likely to outperform global shares, after underperforming in 2023 helped by somewhat more attractive valuations. A recession could threaten this though so it’s hard to have a strong view. Expect the ASX 200 to end 2024 at around 7,500 points.

-

Bonds are likely to provide returns around running yield or a bit more, as inflation slows and central banks cut rates.

-

Unlisted commercial property returns are likely to be negative again due to the lagged impact of high bond yields & working from home.

-

Australian home prices are likely to fall as high interest rates hit demand again and unemployment rises. The supply shortfall should prevent a sharper fall & expect a wide dispersion with prices still rising in Adelaide, Brisbane & Perth. Rate cuts later in the year will help.

-

Cash and bank deposits are expected to provide returns of over 4%, reflecting the back up in interest rates.

-

A rising trend in the $A is likely taking it to $US0.70, due to a fall in the overvalued $US and the Fed moving to cut rates before the RBA.

What to watch?

The main things to keep an eye on in 2024 are as follows: sticky inflation and central banks; the risk of recession & whether it’s mild or deep; the Chinese economy & property sector; US shutdown risks & the presidential election; and in Australia how the consumer and home prices respond to the lagged impact of high rates, including via rising unemployment.

Dr Shane Oliver – Head of Investment Strategy and Chief Economist, AMP

Source: AMP Capital December 2023

Important note: While every care has been taken in the preparation of this document, AMP Capital Investors Limited (ABN 59 001 777 591, AFSL 232497) and AMP Capital Funds Management Limited (ABN 15 159 557 721, AFSL 426455) make no representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This document is solely for the use of the party to whom it is provided.