Introduction

Whenever there are sharp falls in share markets like recently, there is a temptation to wonder whether we are seeing a re-run of the last major crisis. Fortunately, the conditions today are very different to the run-up to the global financial crisis (GFC) which originated in the developed world, notably the US. The developed world hasn’t seen the sort of excesses that preceded the GFC: there has been no generalised bubble in investment spending (housing or otherwise), there has been no asset bubble, there has been no easing in lending standards like that which occurred with sub-prime debt and there has been no build up in inflation pressures or monetary tightening. So it’s hard to see the sort of unravelling in global financial markets that started in interbank lending and credit markets, threatening a seizing up of the global financial system and spreading through all growth assets that we saw through the GFC.

If there is a historical comparison, perhaps it should be to the 1997-98 Asian/emerging market crisis. A big driver of the recent turmoil in global share markets is the growth downturn in China and the emerging world and the fear that this will ultimately affect developed countries. This is of course coming against a background of concerns about the Fed raising interest rates, but more specifically this is arguably exacerbating already existing emerging market problems by adding to downwards pressure on their exchange rates (and upwards pressure on the $US – which is something the Fed needs to be mindful of).

It seemed only yesterday that the emerging world was riding high. But in reality worries about emerging market (EM) countries have been brewing for a while now, with the relative performance of their share markets and currencies struggling since 2011. This note looks at the main issues, but first a bit of history to put EMs in context.

Emerging markets – all the way up…

In the mid-1990s there was much talk of an “Asian miracle”. Growth was thought to be assured by high savings and investment rates, strong export growth and a shift in labour to cities. However, as often occurs during good times, excesses set in including a reliance on foreign capital, current account deficits, excessive debt levels and over-valued fixed exchange rates. Eventually foreign investors had doubts. In mid-1997 Thailand experienced capital outflows that became a torrent and triggered a collapse in its fixed currency, which then led investors to search for countries with similar vulnerabilities. This led to the crisis spreading across the emerging world ultimately contributing to Russia’s debt default of 1998. The Asian/EM crisis, which saw EM shares lose 60%, dragged down global and Australian shares by between 10% to 23% in the midst of both 1997 and 1998 on fears it would drag down developed countries, but with both years going on to provide good returns.

In the 2000s, emerging countries came back into vogue thanks to a range of productivity enhancing reforms, less reliance on foreign capital and low and floating exchange rates and this, along with the industrialisation of China and a related surge in commodity prices (which benefited South America and Russia), saw their growth rates improve. The enhanced perception of emerging countries and a secular slump in the traditional advanced economies at the same time saw them once more come into favour amongst investors.

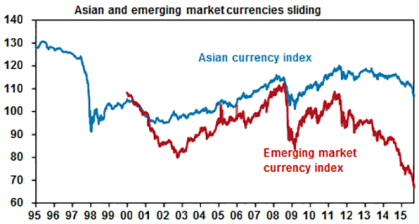

This reached a crescendo after the GFC with talk of a “new normal” of poor growth in advanced countries and their quantitative easing encouraging capital flows to the “stronger” emerging markets leading in fact to complaints of “currency wars” from EMs as their currencies rose. The rise in the value of Asian currencies versus the $US over the last decade as a result of strong capital inflows can be seen in the next chart.

Source: Bloomberg, JP Morgan, AMP Capital

…and then back down again

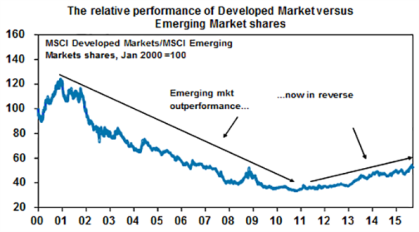

Since 2011, Asia and the emerging world have gone full circle back to being out of favour again. This can be seen in a downtrend in their exchange rates (the emerging market currency index is down 38% from its 2011 high) and a shift to relative underperformance of EM versus developed market (DM) shares.

Source: Bloomberg, AMP Capital

Several factors have led to this turnaround including:

- The downturn in commodity prices impacting South America and Russia.

- Slower growth in China, affecting Asian trading partners.

- A reversal in economic reform momentum as the success of the last decade led to hubris. Brazil and some of South America have reverted to old fashioned populism.

- Some EMs have political problems – eg, Turkey, Argentina & Thailand. Russia has shot itself in the foot over Ukraine.

- The process of reducing monetary stimulus in the US has led to a reversal in the money flow to the emerging world.

- This has all occurred at a time when the flow of news in developed countries has arguably improved with stronger growth in the US, economic reforms in Europe and Abenomics in Japan.

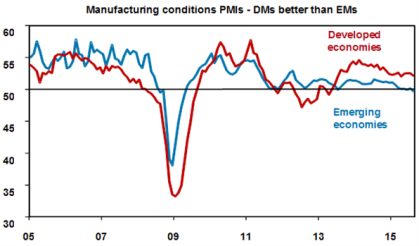

Emerging market problems were thrown into sharp focus when China devalued the Renminbi a month ago, which led to added concerns about Chinese growth and worries about more downwards pressure on EM currencies. The combination of these developments and higher interest rates in some EMs to combat inflation has been to push growth down and this is evident in emerging market PMIs (surveys of businesses regarding their conditions) falling below those in developed countries. Brazil and Russia are already in recession.

Source: Bloomberg, AMP Capital

Comparisons to 1997-98

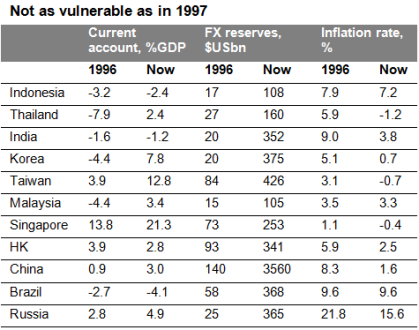

Despite the change in fortunes, the overall position of emerging countries is arguably stronger today than it was prior to the 1997-98 crisis. Current account balances are generally in better shape, foreign currency debt is lower, foreign exchange reserves are much higher, exchange rates are mostly floating rather than fixed which means they don’t have to be defended from speculative attacks and inflation is lower providing more flexibility to undertake monetary stimulus. China is critically important in the emerging world and fortunately it is arguably in a strong position to support growth in its economy (with plenty of scope to cut interest rates, little reliance on foreign capital, capital controls protecting against heavy capital outflows, manageable public debt and very strong foreign exchange reserves) and plenty of incentive to do so. Further stimulus measures are likely to be announced in China.

Source: IMF, Bloomberg, AMP Capital

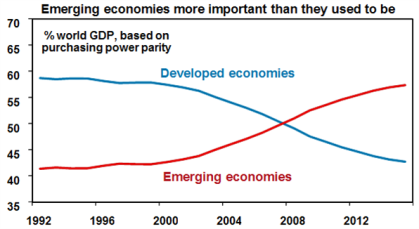

However, several countries are vulnerable thanks to current account deficits, eg Brazil and Indonesia, there has also been a degree of overinvestment in parts of Asia which has created chronic deflationary pressures, the lack of reform and adoption of populist policies in several EMs looks here to stay (until a crisis forces a change in direction) and China and the emerging world are a lot more important globally than was the case in 1997 so their impact on developed countries and global growth has the potential to be greater. See the next chart.

Source: IMF, AMP Capital

So overall we don’t see a return to the 1997-98 Asian/emerging markets crisis, but it’s worth keeping an eye on.

Implications for investors

There are several implications for investors:

First, notwithstanding likely bounces along the way, the secular underperformance by emerging market shares relative to developed market shares could have a fair way to go yet given the extent of outperformance last decade.

Second, in the current environment emerging markets are best invested in on a selective basis focussing on those less vulnerable to capital outflows (eg with large current account surpluses), less vulnerable to weak commodity prices and with less pressing structural problems, eg Korea and Mexico over Brazil.

Third, given the greater importance these days of China and the emerging world the risk that problems in the emerging world affect developed country growth cannot be ignored. But if we are right and China manages to stabilise its growth then the impact should be minimal and limited to periodic scares as we saw in 1997 and 1998, rather than triggering a new global economic downturn & bear market in developed country shares.

About the Author

Dr Shane Oliver, Head of Investment Strategy and Economics and Chief Economist at AMP Capital is responsible for AMP Capital’s diversified investment funds. He also provides economic forecasts and analysis of key variables and issues affecting, or likely to affect, all asset markets.

Important note: While every care has been taken in the preparation of this article, AMP Capital Investors Limited (ABN 59 001 777 591, AFSL 232497) and AMP Capital Funds Management Limited (ABN 15 159 557 721, AFSL 426455) makes no representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This article has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this article, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This article is solely for the use of the party to whom it is provided.