Dr Shane Oliver – Head of Investment Strategy and Chief Economist, AMP Capital

Introduction

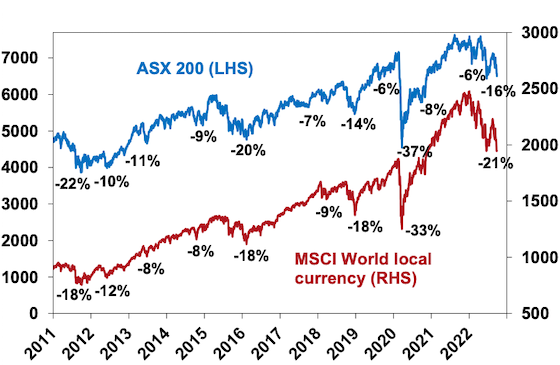

Investors could be forgiven for looking back on the pandemic years of 2020 and 2021 with fond memories – because after the initial shock in February-March 2020 it was a period of strong returns and relative calm in investment markets. This year has been anything but. After falling sharply into mid-June (at which point US shares had fallen 24% from their highs, global shares 21% and Australian shares 16%), share markets rallied into mid-August reversing half of their declines on the back of hopes the Fed would pivot towards an easier monetary stance and hopefully avoid a recession. Since mid-August though shares have fallen again and are now back to around their June lows.

Share markets back down

Source: Strategas, AMP

And, bond yields have pushed up again with US, UK, German 10-year yields rising to levels not seen in a decade.

What’s driving the renewed weakness

The plunge in shares back to their June lows mostly reflects the same concerns that drove the falls into June:

-

Inflation remains high or is still rising depending on the country. For example, US headline inflation is still 8.3%yoy and core inflation at 6.3%yoy in August is still under pressure from rising services inflation. Headline inflation is 8.9% in the UK, 9.1% in Europe, 9.9% in the UK and an estimated 7.2% in Australia.

-

Global central banks have become more hawkish noting that permanently high inflation will lead to lower living standards and the longer inflation stays high the greater the risk that inflation expectations move higher, making it harder to get down. As a result, they are committed to getting it back to target and have been flagging more rate hikes (eg with the dot plot of Fed interest rate forecasts around 1% higher than 3 months ago – next chart) and an implied tolerance for a recession in order to get it under control.

-

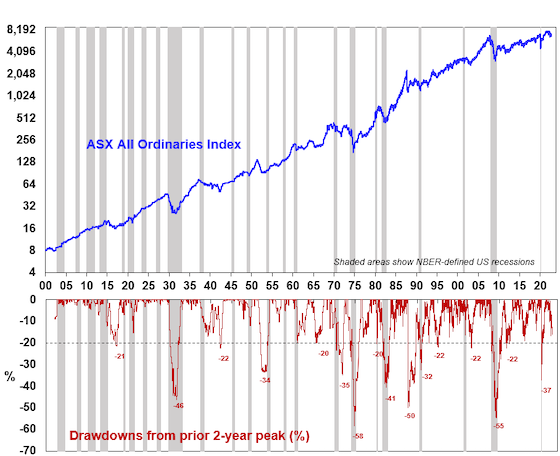

Increasingly hawkish central banks are bad for shares in the short term for two reasons. First higher interest rates and make shares less attractive from a valuation perspective. Second, a recession would weigh on company profits. Recession is now almost certain in Europe and about a 50% probability in the US. In Australia the probability of recession is now around 40% (if as we expect the cash rate peaks around 3%, but if it rises to 4.3% as predicted by the money market then recession is probable here). Historically deep bear markets in US and Australian shares have tended to be associated with a US recession.

Australian equity bear markets and US recessions

Source: ASX, Bloomberg, AMP

-

Fears of an escalation of the Ukraine war – after Russia’s troop mobilisation, “referenda” to incorporate occupied areas into Russia and a threat to use nuclear weapons. Ongoing tensions with China and the approaching November US mid-term elections are not helping.

-

A large fiscal stimulus in the UK has caused a surge in UK bond yields & plunge in the pound adding to fears of a crisis. While the new Government’s tax cuts and deregulation may have supply side merit the benefits of this tend to take years to become apparent and in the meantime the risk is that it adds to inflation and fears about runaway debt.

-

We are in a weak period of the year seasonally for shares – with September being the weakest month of the year on average for shares and October known for volatility. This can be magnified when the trend in shares is down.

-

As seen in the first half the year, tech stocks and particularly crypto currencies remain the biggest losers of monetary tightening, after being the biggest winners of easy money.

Shares are oversold and on technical support at their June lows so could bounce from here. But the risks are skewed to the downside in the short term. While investor confidence is very negative, we have yet to see the sort of spike in put/call option ratios or VIX that normally signals major market bottoms. The RBA is fortunately starting to sound a bit more balanced and aware of the way monetary policy impacts with a lag, but the danger is that the Fed and central banks have become locked into supersized hikes based on backward looking inflation and jobs data, and a loss of confidence in their ability to forecast inflation at a time when they should be giving more attention to monetary policy lags. This increases the risk of overtightening driving a deep recession with earnings downgrades driving another leg down in share prices (after the first leg down which was driven by rising bond yields). A decisive break below the June low for the US share market could open up another 10% leg down with a similar flow through to Australian shares.

It’s not all doom and gloom

However, there is some light at the end of the tunnel on a 12-month view:

-

Central banks determination to stop high inflation becoming entrenched is good news from a longer-term perspective as the 1970s experience tells us that the alternative would be bad for economies, jobs and investment markets.

-

Producer price inflation looks to have peaked in the US, UK, China and Japan.

-

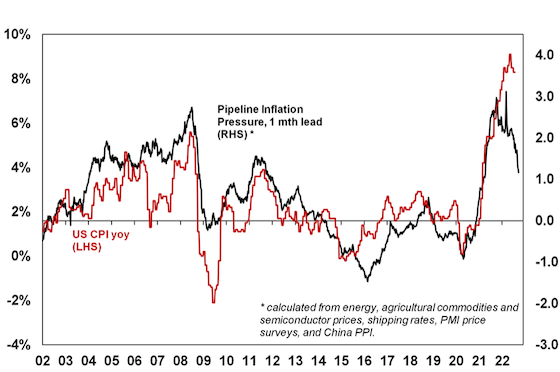

This is consistent with our Pipeline Inflation Indicator which is continuing to trend down given falling price and cost components in business surveys, falling freight rates and lower commodity prices (outside of gas and coal).

AMP Pipeline Inflation Indicator

Source: Bloomberg, AMP

-

Some of the key components that initially drove higher inflation in the US are starting to slow with weakening growth in new market rents (which with a lag drives about 33% of the US CPI) and softening used car prices.

-

Consumer inflation expectations have fallen in the US and Australia, helped by aggressive central bank moves and falling petrol prices. US 5 year plus inflation expectations have fallen back to 2.8% which is well below the near 10% level seen in 1980. This should make it easier for central banks to get inflation back down without having to take interest rates to exorbitant levels.

-

Money supply growth has slowed from its 2020 surge, and this is likely to contribute to lower inflation ahead.

-

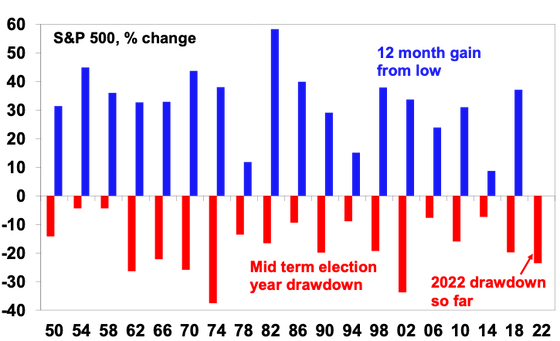

Post US mid-term election returns tend to be strong, just as mid-term election year drawbacks tend to be more severe – with an average top to bottom fall of 17% in US shares in mid-term election years followed by an average 33% gain one year from the low.

US mid-term election year share market drawdowns

Source: Strategas, Bloomberg, AMP

The bottom line is that while short-term inflation remains high, these considerations are consistent with the US having reached peak inflation and point to lower inflation ahead which should enable central banks to slow the pace of hiking by year end, in time to avoid a severe recession. If this applies in the US, then Australia should follow as its lagging the US by about six months with respect to inflation. (Although we expect the RBA to slow the pace of rate hikes well ahead of the US – given the greater sensitivity of the Australian household sector to higher rates than in the US and lower inflation pressures in Australia.) For this reason, while short term risks around shares remain high, we remain optimistic on shares on a 12-month horizon.

Key things for investors to bear in mind

Sharp share market falls are stressful for investors as no one likes to see their investments fall in value. And try as one may, it’s never easy to accurately predict economies and shares. So, at times like these it’s important to focus on basic investment principles. In particular, these things are worth keeping in mind:

-

share market pullbacks are healthy and normal – their volatility is the price we pay for the higher returns they provide over the long term;

-

it’s very hard to time market moves so the key is to stick to an appropriate long-term investment strategy;

-

selling shares after a fall locks in a loss;

-

share pullbacks provide opportunities for investors to buy them more cheaply;

-

shares invariably bottom with maximum bearishness;

-

Australian shares still offer an attractive income (or cash) flow relative to bank deposits; and

-

to avoid getting thrown off a long-term strategy – it’s best to turn down the noise around all the negative news flow.

Source: AMP Capital September 2022

Important note: While every care has been taken in the preparation of this document, AMP Capital Investors Limited (ABN 59 001 777 591, AFSL 232497) and AMP Capital Funds Management Limited (ABN 15 159 557 721, AFSL 426455) make no representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This document is solely for the use of the party to whom it is provided.